More than a victory, a triumph

Donald Trump and the Republicans have won full control of the White House and Congress. This scenario, which came with rather low odds in the opinion polls, has extended the “Trump trade” (bullish equity market and rising US long-term yields and dollar) and has this time around created a wider dichotomy between the United States and Europe (where equity indices and long-term yields are declining). Investors have focused on the Republican candidate’s promises of lower corporate taxes and deregulation in the US and rising tariffs for other trade partners – Europe included.

They have also factored in deeper public deficits (rising real and nominal rates) and higher inflationary risks (rising inflation break-even rates). Markets have experienced violent swings since early October and the beginning of the “Trump trade”, with the S&P500 outperforming the Eurostoxx 50 by almost 9%.

Is the Trump programme so favourable?

While many aspects of Donald Trump’s programme are positive for the economy and for corporate profits – according to estimates, lowering corporate taxes from 21% to 15% would boost US company profits by almost 5% - others may also have negative upshots:

- The deportation of illegal immigrants. Using highly conservative assumptions, the negative impact on growth is estimated at 0.1% - 0.4% of GDP in the first year according to Brookings1 based on the levels set out in the electoral promise. The cumulated impact would climb to 2.9% - 19.6% of GDP over 4 years in a median growth scenario according to the Peterson Institute.2 These estimates depend on multiple assumptions and the relevance of the models used; however, the key takeaway here is that the impacts of such a policy cannot be overlooked.

- Levying tariffs on imports would clearly detract from economic growth in the US. Here again, the impacts depend on the assumptions chosen (10% or 20% for all countries in some statements, 60% for China…), on the models, and on potential reciprocity from trading partners as they respond to higher tariffs. The Tax Foundation has supplied its own estimates as well as a summary of other sources3. The IMF foresees a recession impact of 0.4 to 0.6% on GDP if tariffs are increased by 10%.

- When President Trump imposed tariffs in 2018, the Fed’s approach was to consider that faced with the short-term inflationary effect and a recession, it could afford to pay more attention to the second while inflation forecasts were steady and that the markups from higher taxes remained moderate – which they were at the time. However, the situation in 2025 is very different to 2018 and the Fed still cannot claim it has won the battle against inflation. Torn between the risk of fuelling tensions on the labour market due to the deportation of immigrants and uncertainty over tariffs, it seems likely that the Fed’s normalisation of monetary policy will be rather timid… if anything because it doesn’t want to have to raise its rates again!

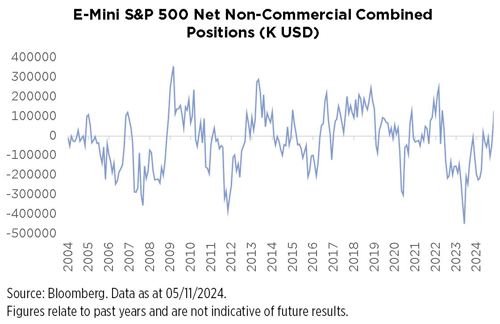

- Portfolio positioning data suggests that the “Trump trade” is already largely present in investor portfolios and that the ‘euphoria’ that took hold the US stock market should soon come to an end.

Overall, after this market movement which proved consistent with the scenario of a Republican Red Sweep, the agenda chosen by the new administration will determine the future market impact of a political programme intended to be radical and transformational.

Europe: is pessimism overdone?

There is no doubt that Donald Trump’s election and the threats of tariffs (possibly amplified for the car industry) has exacerbated investor scepticism towards Europe, also at a time when Germany and France are both in great difficulty – though for different reasons.

But let us not forget that European companies with a cost base in the US will benefit from the lower corporate tax rate. According to Morgan Stanley’s estimates, while 26% of the sales generated by MSCI Europe companies are exposed to the US, the percentage of exports – threatened by the tariffs – is only 6.2%.

European equities are now trading at a record discount relative to their US counterparts, yet Europe is not in crisis. We have also observed that the economic surprise index has tended to recover a little over the past few weeks.

In Germany, the likely change of government could bring more favourable news on the fiscal front. The CDU leader, Friedrich Merz, has recently appeared open to reforming the strict rules that govern budget deficits – the debt brake - on the condition that new expenditure is used to fund investment programmes. Germany has all the fiscal levers it needs to rebound and while the political will has not been clearly expressed so far, the lines are shifting. This will be an important factor to watch over the next few weeks.

Investment policy

With the “Trump trade” clearly closer to the end than to the beginning and likely excessive doom and gloom in Europe, we believe it is now too late to strategically overweight US equities over Europe. However, we did increase our exposure to US equities immediately after Trump’s election – though this was a highly tactical move. This trade was offset by lowering our exposure to emerging equities excluding China. Indeed, the threats of tariffs and reduced visibility on the rate cutting cycle are jeopardising growth prospects in the emerging space and creating more instability for their currencies.

1. https://www.brookings.edu/articles/immigration-and-the-macroeconomy-after-2024/

2. https://www.piie.com/events/2024/economic-effects-trumps-plans-tariffs-deportations-and-fed

3. https://taxfoundation.org/blog/trump-tariffs-impact-economy/

TO SUM UP

- With the “Trump trade” clearly closer to the end than to the beginning and likely excessive doom and gloom in Europe, we believe it is now too late to strategically overweight US equities over Europe.

- However, we tactically increased our exposure to US equities following Donald Trump's election.

- Our exposure to emerging equities excluding China has been lowered due to the threats of tariffs and reduced visibility on the rate cutting cycle.